Our Services

Providing Premium Insurance Audit Services Since 1977

GDD employs an audit management system with real time accuracy for optimal tracking of your audit request. Audit requests are scanned via image technology and are always accessible to both the field auditor and the office staff to better serve your specific needs.

Quality control is maintained by a staff of experienced insurance premium auditors using the latest hardware and software technologies. All auditors are knowledgeable and experienced in Workers Compensation, General Liability, Fleet and Garage Audits (Dealer and non-dealer).

Our Audit Review Staff is the best in the industry. Each review staff member is experienced with all types of insurance coverage. All audit reviewers are required to keep pace with industry standards and classification changes.

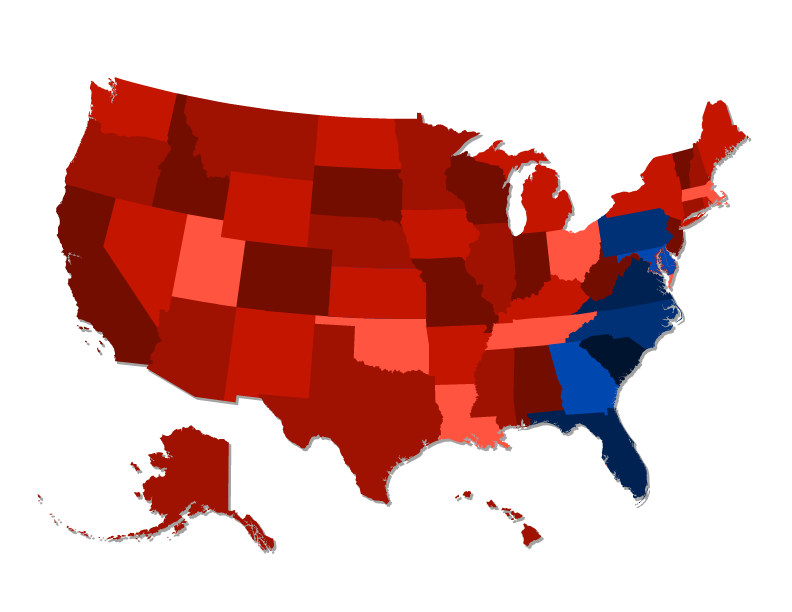

We conduct Physical Audits currently in Florida, Georgia, South Carolina, North Carolina, Virginia, District of Columbia, Maryland, Delaware, and Pennsylvania.

Physical Audits

GDD Associates, Inc. will audit the records of businesses to determine proper insurance premiums. This service requires a GDD employees to schedule an appointment and visit the insured business to review payroll and/or sales records. These auditors are required to provide verification to determine exact chargeable exposure. We use general ledger, accounting journals, profit and loss statements and other methods to verify exposure. Our auditors are trained to ask the right questions to determine correct exposure. Auditors will apply state workers' compensation rules to determine proper classifications and exposures for each business audited. A physical audit includes direct contact with the policy holder and/or audit contact by one of our experienced field auditors. We do not charge zone, fuel, or other fees.

We conduct Hybrid Audits, Mail Audits and Telephone Audits in all 50 states.

Hybrid Audits

Our Hybrid audit is a direct replacement for a physical audit. The audit is completely verified to the policy period with all the same documentation requirements as a physical audit. The auditor spends time talking with the policy holder to determine detailed description of operations and job duties for employees. Documentation is attached to the final Audit Worksheet with auditor notes and a complete description of operations with verification of classifications used. Contact us to discuss the difference between a Hybrid audit and Telephone audit.

Mail Audits

Our Mail audits are handled individually by experienced auditors who will represent your company with the highest standards of excellence. Worksheets are mailed to the policy holder and the audit contact is asked to fill-in all information needed for your company's satisfaction such as current locations, current officers, payroll for exact policy period, amounts paid to 1099 workers as well as amounts paid to subcontractors. The policy holder is also asked to submit Federal and State Quarterly reports along with other documentation which should include Certificates of insurance for subcontractors and 1099 workers. The auditor will also call the insured if any questions arise during the audit process to confirm suspected classification changes or any other questions which arise during the write-up process.

Telephone Audits

We offer verified (documented) and non-verified (non-documented) telephone audits on a nationwide basis.